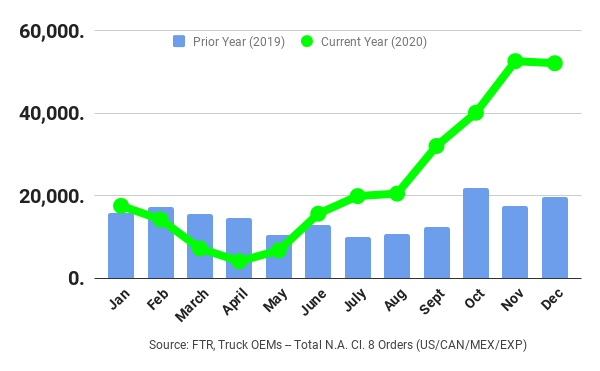

New truck orders collapsed during the start of the COVID-19 pandemic, but orders of Class 5 through 8 trucks bounced back at the end of the year, nearly breaking sales records.

Preliminary North American Class 8 sales numbers from FTR and ACT Research estimate between 51,000 and 52,000 trucks were sold in December. This is the fourth highest sales month on record. Monthly truck orders were down just slightly compared to November, another record month. Sales were over 10 times higher than the 5,000 units that sold in April, when the trucking industry was facing shutdowns across the country. In total, sales for November and December represented more than 1/3 of the 283,000 trucks sold this year.

According to ACT, 35,100 Class 5-7 trucks sold in December, which is 28% higher than November and 73% higher than sales in December of last year. This is the second best selling month on record, outpacing North American Class 8 sales.

Don Ake, vice president of commercial vehicles at FTR, sees this becoming a long term trend throughout the trucking industry: “As the economy continues to improve, fleets are showing increasing confidence about business conditions in 2021. Profits are more than sufficient to replace used trucks and freight growth is stimulating expansion demand. Put those dynamics together, and the industry is headed toward a robust year.”

Kenny Vieth, president and senior analyst at ACT, sees strong truck sales being closely tied to the explosion in retail sales: “The pandemic-impacted economy continues to play into the hands of trucking, as consumers continue to substitute spending on services with spending on goods, even as the manufacturing sector begins to ramp. There is a symbiotic relationship between heavy-duty freight rates and medium-duty demand. Clearly, the shift in consumer spending from experiences to goods has been good for the providers of local trucking services as e-commerce has grown by leaps and bounds during the pandemic.”

While the obstacles posed by COVID-19 are new, Convoy’s Aaron Terrazas believes that lessons learned from the homebuilding industry during the financial crisis of 2008 can teach a few things. Terrazas states, “The path the homebuilding industry took following its bust could provide a blueprint for what trucking can expect as it recovers from a similarly severe downturn. The lesson is that carriers may be particularly slow to add capacity as the freight economy emerges from the COVID-19 recession.”

He continues, “By most accounts, the risk-taking homebuilders that expanded aggressively in the boom years were the ones who had quit, leaving the industry dominated by larger, risk-averse businesses…if we look to lessons from homebuilders over the past decade, it’s likely that many carriers in the trucking industry will take a relatively conservative approach to expansion once demand does start to heat up.”

What this means for the trucking industry will be unique to the goals set by each company as well as the current outlook regionally; however, if lessons are to be learned from the past, slow, steady and progressive growth may be the goal as opposed to jumping right back in with guns blazing.